5G killer applications and how to prepare for them

Mobile Network Operators (MNOs) have started to roll out 5G networks in many parts of the world. Marketed 5G business cases and application areas that are supposed to lead to Return of Investment (ROI) for these networks often comprise:

- Faster speed and more data. In other words, more of the mobile broadband you already have today. Marketing activities in this are often about how fast you can download a movie to your phone.

- Ultra-low latency. This is where you find marketing buzz around remote surgery and ability to control machines in a mine. Augmented Reality (AR) and Virtual Reality (VR) applications are often mentioned as well, sometimes along with edge computing.

- (Industrial) Internet of Things use cases. The 5G pitch (over 4G, LoRaWAN and other Low Power Wide Area Network standards) includes the ability to connect very high numbers of devices in a defined area.

- Self-driving cars. A vision that a self-driving car would be controlled remotely rather than using on-boarded video/sensor systems for driverless navigation and vehicle-to-vehicle communication.

- Fixed Wireless Access (FWA). This means that rather than digging down fiber cables all over a country, the last mile access to your home or office could be handled by a 5G radio link.

These five areas have one thing in common: None of them will take off in scale anytime soon and they will therefore not be the short-time cash cow that many MNOs have been hoping for.

If we look at previous generations of mobile networks, the situation has been similar. Before 2G took off, GSM was pointed out as an economical fiasco by many media channels. No one expected SMS and MMS to be killer apps and that every single person would carry a phone a few years later.

With 3G, the expected use cases were highly influenced by the bandwidth-limited Wireless Application Protocol (WAP) that was released in 1999, and marketing activities were therefore centered around narrow bandwidth use cases like ”what is the value of this stock?” and ”how much does this product cost?”. A few years later, the iPhone was released, and it paved the way for actual business models like the mobile Internet, the avalanche in data usage, app stores and over the top services that mobile operators have been able to profit from.

4G was less of a tombola. The result of smartphones flooding the market in 2009 while 4G was rolled out for IP based Internet traffic made it a trustable investment. However, it was not broadcast/multicast video, other IP Multimedia System (IMS) services or acquired media companies that generated revenues for mobile operators. Instead, third-party video platforms from Netflix and Youtube have been driving traffic in the networks.

With all this in mind, a fair bet is that new, yet blurry application areas will drive the usage of 5G networks. We acknowledge 5G to be the wireless infrastructure that will fuel macro economies for many years to come in a world where wireless becomes the norm, but asking someone to build a nationwide network with tens of thousands of sites without a visible business case is challenging.

Also, if we look at what customers, device manufacturers, application developers and service providers really are asking for today and will need tomorrow, it is not lower latency, higher bandwidth

or a 5G icon on their screen but better coverage and higher network availability. To be able to deliver this, an MNO needs to find ways to build a more dense footprint in a more cost-efficient way. Fortunately, 5G brings tools that could help with that.

What we focus on in this article are three ”silver bullet” areas to help an MNO establish a long-term 5G presence and become relevant for device manufacturers, service providers, enterprises, industries

and other verticals who want to get access to reliable and ubiquitous wireless connectivity. The aim is to provide ”coverage everywhere” in the long term while revenues are secured short-term.

Strategy area #1 – Let someone else pay for your footprint

When the first cars became available more than 100 years ago, there were not many places you could drive them. The first decent roads were built inside of cities and between bigger cities, but the ”coverage” was non-existing in most places. With more cars, more ”use cases” and higher demands from the drivers, local infrastructure was built out and today we see roads as ”ubiquitous”. We can drive everywhere. The coverage is complete.

In a not too distant future, the phones we keep in our pockets most of the time and which are developed to cope very well with spotty network coverage and data buffering will be accompanied and ultimately replaced by new types of ”super power” gadgets like AR glasses, real-time translation earplugs and Internet of Things (IoT) devices. As with the roads, this leads to new requirements on network availability and quality:

- Ubiquitous network coverage will be demanded. Imagine that you wear equipment providing you with wayfinding, games, instructions, real-time translation or other useful information from a cloud service. Buffering of data will not be an option. You will likely not be interested in having to type in new Wi-Fi passwords at every location you visit.

- In the age of the customer, everyone wants to buy services rather than products. When you pay for connected devices (like a dishwasher, glasses or a razor) you expect whoever charges for the service to also guarantee the device works flawlessly 24/7 regardless of location.

- Wearables that transmit and process a lot of data will consume a lot of energy. If you have tried an AR app you have probably noticed your phone getting warm and the battery draining quickly. Energy efficiency will be crucial for body near devices and IoT. Indoors, this is only possible if your device is connected to an indoor radio network and does not have to penetrate walls and windows to reach an outdoor macro base station.

- In order to lower the latency and improve battery lifetime for real-time VR/AR applications, video encoding/decoding may be omitted in the device. This could easily lead to 10x higher bandwidth requirements than what we see today.

With more and more thins being delivered as a service, whoever provides the best connectivity layer in all locations is best positioned to be valuable in the service value chain. Gadget vendors and service providers like Google, Amazon and Apple have already understood how critical ubiquitous mobile coverage is for their business models and they are addressing this in different ways. Some examples:

- Alphabet created their own Mobile Virtual Network Operator (MVNO) several years ago. It is called Google Fi and provides network connectivity by switching users between Wi-Fi and two MNO networks (Sprint and T-Mobile) in the US. All traffic is tunneled back to Googles Core network. In other words, Goole Fi is hiding the MNO networks from the end users. By using three different types of networks, coverage is vastly improved compared with a single network.

- Apple has been pushing for eSIM for many years. The short-term plan is that end users should be able to switch MNO without swapping the physical SIM card, but it also opens up for the possibility that Apple can switch adaptively between MNOs to the best network at every location when new products are around.

- Amazon has for long been surrounded by rumors that they could become a mobile operator through acquisitions or partnerships. They are not interested in the mobile operator business model as such, but they want to ensure their customers are connected all the time and to be able to for example control drones and driverless vehicles used for delivery.

- Microsoft has tried various ways of embedding wireless connectivity in their operative system.

MNO relation where the Service Provider has to make sure that their products come with decent network access.

All arrows are pointing in the same direction: Mobile coverage will increase in value in all types of locations and whoever can provide the best network and ability to deliver predictable performance has the best chance to deliver services and be a relevant partner for companies like the ones listed above.

This is where we have the Mobile Operator dilemma. Their coverage is good outdoors, but they are often irrelevant in many indoor locations and lack relations with building/venue owners. The reason for this is how in-building systems have been deployed over the past decades and how the traditional MNO business model is structured. With 5G, you would think indoor penetration was targeted, but all new 5G spectrum that is actioned will end up in the same outdoor sites where 4G systems already are deployed. This leads to MNOs missing out on the indoor space where a lot of the emerging 5G-related business cases will pop up.

So the question comes down to what an MNO could do to improve the indoor presence while minimizing risk and maximizing short-term revenue. How can they get indoors for free to offload the outdoor macro network (and remove macro sites), serve indoor users, build new business models and long-term relevance? The answer is simple: Let someone else pay for the cellular footprint.

Willingness to pay for premium wireless services exists, especially from construction companies, in hospitals and public buildings. Stadium owners are also interested, especially if they are able to control video content to all visitors in the venue regardless of operator. These things should to be ticked off for the solution to take off in scale:

- All main operators in the region have to be represented. Building owners and construction companies are not interested in single-MNO infrastructures that come with lock-in effects.

- The indoor system should use different spectrum than the outdoor macro networks. This results in much easier planning/design and lower small cell node count for the indoor network. It also means less interference and macro network issues.

- The indoor system should be based on a small cell system powered over Ethernet, where the operators are sharing the radio hardware and maybe also the baseband. Alternatively, their Public Land Mobile Network (PLMN) ID could be represented by the infrastructure through 3rd party agreements. This brings down the Bill of Material to very reasonable levels.

This kind of multi-operator solution could be white labeled and sold as a service via system integrators or directly to construction companies. Professional services, including design, could be offered by the MNOs.

Once the infrastructure has been deployed (at zero cost or with a positive business case) in enterprises, hospitals, campuses and stadiums, the MNOs could build services on top. Some examples are local breakout of data through private virtual networks, IoT connectivity, IoT sensing as a service, multicast video with venue owner control, building automation and wayfinding applications. Or they could sell slices of connectivity to Amazon and Google for their products to camp on. In other words, they have built long-term relevance both indoors and outdoors. For free.

Strategy area #2 – Private LTE/5G networks as a service

“Private LTE/5G is a dedicated network for consumers, businesses and Internet of Things. Private LTE/5G can be based on licensed, unlicensed or shared spectrum“

Alex Besen, The Besen Group

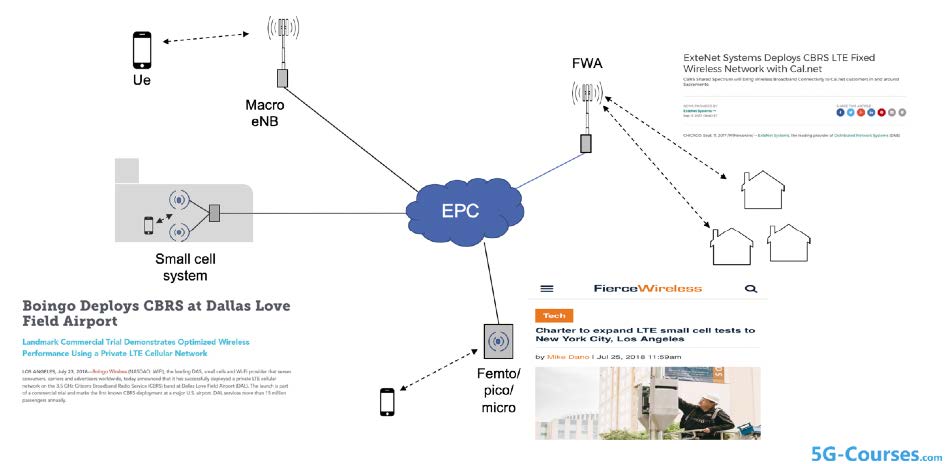

Private LTE/5G networks are gaining momentum all over the world. Shared 3.5GHz spectrum is released in many regions with small cell hardware and scalable AWS based Core as a Service-models popping up in many forms. Awareness and interest for private cellular connectivity is on the rise in all kinds of enterprise and industrial organizations. The figure below shows the four main ways of building these networks.

- Macro networks: Typically outdoors in anything from an industrial area to a small city.

- Fixed Wireless Access (FWA): This is commonly used as xDSL/Fiber replacement to residential or industrial buildings.

- Small cell systems: Built indoors with coordinated base band resources.

- Femto/pico/micro base stations: Could be deployed outdoors or indoors, typically to cover a hotspot. In some cases, clusters of Femto cells are used to cover bigger areas like an airport.

Private cellular networks have traditionally been provided by Mobile Network Operators, DAS providers, tower companies or in some cases mobile equipment vendors. Receivers of these solutions could look like this:

- Harbors, mines, oil platforms, ships, first responders and airports where secure and highquality connectivity is required for a mobile workforce and connected vehicles/devices. For mobile use cases, a 4G or 5G network easily outperforms DECT or Wi-Fi even from a CAPEX perspective. One example is Boingos deployment at the Dallas Love Field Airport where a private LTE network was rolled out on shared 3.5GHz spectrum. The entire airport was covered by only five 4G radio nodes. This can be compared to the about one hundred Wi-Fi access points that are installed in the same area. When costs for patch cables, Power over Ethernet switches, drilling and installation are taken into account, the private cellular network comes out both cheaper and with superior mobile performance.

- Many large industries are looking at private 5G networks as an option to spotty and poorly performing Wi-Fi networks. As an example, German car manufacturers are expressing interest in deploying their own 5G networks. Control of coverage, ability to break out traffic locally, high QoS and reliability are some of the main drivers.

- Hospitals where old DECT phone systems and fax machines need to be replaced and where more and more IoT solutions are deployed.

- Enterprises having poor or no cellular coverage today and where local breakout of mobile data is critical.

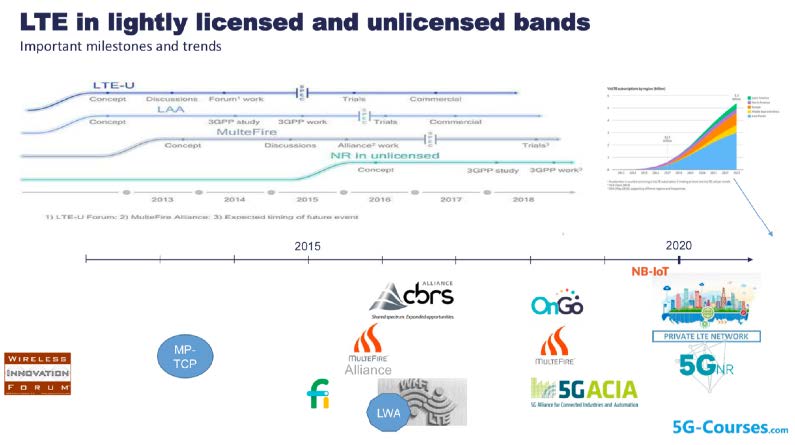

New Private 4G/5G standards, products, certification programs, spectrum and alliances are released continuously as shown in the below figure. One great example is the CBRS spectrum in the US which has got its own on-boarding and certification program (OnGo).

With easier access to spectrum, products that are ”as simple as Wi-Fi to deploy” and customers who demand better wireless connectivity we will see a lot of non-MNO organizations rolling out 4G and 5G systems in the coming years. Most of these organizations come from the Wi-Fi direction and they will run into problems where an MNO can position services. Some examples:

- Lack of sufficient skills to design and operate reliable mobile 4G/5G networks.

- Ability to handle macro network handover. Many networks will be Intranets, but every network has its boundaries, and the ability to handle devices that are ”leaving the building” is crucial.

- Core network is a crucial component of the 4G/5G architecture that an MNO could deliver as a service. With for example DECOR (Distributed Core) a local breakout of data and IoT Intranets can be provided.

The MNO business case here is to packetize Private LTE/5G networks and related functions as a service. The traditional business where you charge per MB of data will not be relevant, but every enterprise is asking for connectivity as a service today and they are willing to pay for design, optimization, rollout, configuration of virtual private networks, local breakout of traffic and support. An MNO is well suited and staffed to create these types of offerings and then packetize and sell it through channel partners and system integrators.

Strategy area #3 – Macro network cost savings

The mobile industry is traditionally bound to a legacy model where ”spectrum” is the main asset for an MNO, where ”data connectivity” is the product being sold and where the Average Revenue Per User (ARPU) is eroded year by year as consumers are getting access to bigger buckets of data all the time. If we look at how income is generated, we can use this simple formula:

Income = Profits – Costs

As discussed earlier in this article, profits will not automatically jump up with 5G without relevant content being added for the consumers. In order to increase revenues and keep a healthy business model while still securing the future 5G network footprint (by maximizing coverage and presence), MNOs should therefore focus on cost reduction in the rollout phase to end up in a healthy position.

The main challenge with this is that 5G currently is deployed the same way as 2G, 3G and 4G. This leads to 5G Capital Expenditures (CAPEX) being similar to previous network generations, but it also drives a range of new costs:

- If 5G deployments are carried out on millimeter wave (mmW) spectrum, the radio waves have issues penetrating objects. Not only walls and windows, but even your fingers can easily block mmW signals. This results in a lot of more sites having to be built, especially to obtain indoor coverage.

- Higher targeted bandwidth in 5G brings new backhaul requirements for sites. One or several fiber pairs or equivalent backhaul will be required per site to provide advertised peak rates.

- Massive MIMO antennas might be used to improve spectral efficiency at 5G sites, but these antennas are heavy, costly and may lead to new radio mast requirements and new site engineer skills.

- The 5G standard offers more than 200 times more radio parameters than 4G. This complexity drives Operating Expenses (OPEX) and sets higher requirements on network optimizers and support personell.

So what could an MNO do in order to minimize the 5G investments without compromising on network performance? There is potential, and this is where “cost savings” become an important strategy:

– Technically, there is little that stops MNOs from cooperating and sharing sites or even base station hardware in a country. In many countries, MNOs are already doing this outdoors, especially in rural areas. In Sweden, there are four major MNOs sharing two 4G networks. This evolution is also powered by acquisitions and collaborations.

5G is much more flexible in its architecture than previous 3GPP releases, and modern base stations are software defined and serve 2G/3G/4G/5G on common hardware. This means it is possible to build the architecture smarter and more cost-effective, especially in modernization projects where old 2G/3G/4G sites are upgraded with less and more power-effective hardware. Core networks could be distributed where it makes sense, cloud-based Radio Access Network (RAN) components could be used to reduce the cost per deployed base station and network slicing will offer the possibility to lease capacity to/from 3rd party players and private networks.

More complex configurations means automation and machine learning will play a central role for network operation and management. Artificial Intelligence (AI) will lead to savings in radio tuning, network planning and predictive maintenance. A great example of an operator who has succeeded in this area is the Finnish MNO Elisa.

Machine Learning can also be used in combination with motor-controlled antennas and filters in order to reduce site visits and to optimize networks on demand to serve busy areas.

Summary

This article has listed three ways for an MNO to build relevance for future 5G-based business models:

- Let someone else pay for your network.

- Deliver Private LTE/5G networks as a service.

- Cooperate, collaborate and use AI to minimize macro network investments.

When looking for 5G ”killer apps”, we have to accept that these will be invisible until networks are available, chipsets prices are dropping, terminals are available in the right price point and ”over the top players” have figured out how they can use the new infrastructure. AR, self-driving vehicles and holograms sound fantastic, but the actual killer apps might look very different.

What we know is that MNOs are only relevant outdoors and that they currently are building 5G networks to offload hotspots. To stay relevant when things are moving quickly towards shared economies and ”everything as a service”, these MNOs need to start thinking and acting in new ways.

They have tried to build IoT platforms, they have acquired media companies and they are trying to offer IT services. It is time to get back to their core and start asking questions like whether it is smart to pay billions of dollars for new spectrum while the actual increase in capacity over the past decades mainly comes from higher densification of base stations (better spectral efficiency). Building indoor systems would lead to a reduction of macro base station sites. They should reach out to other MNOs and look for cooperation. They should use their main assets (spectrum, radio know-how and macro footprint) as a shoehorn to get into buildings and build relations and relevance.

For this MNO transformation, 5G is the right technology to use. 4G was never developed for neutral host deployments and the architecture was not intended to be flexible with cloud based Radio Access Networks and fiber to every site. It did not have to cope with terminals that were body-near, embedded in clothes or placed in front of our eyes all the time and it does not offer slices of capacity that can be sold to service providers. 5G addresses all of this and it is cheaper to build out.

It is time for MNOs to decide. They can stay outside in their masts and be left out in the cold. Or they can get inside and develop new business models.

Author of this article Oscar Bexell has 20 years experience from working with all kinds of wireless networks. He is frequently consulted as a lecturer, speaker, writer and strategic advisor in areas such as Low Power Wide Area Networks (LPWAN), Wi-Fi, 4G, 5G and the Internet of Things.